Long-Term Care Planning: A Step Towards a Secure Future

Get Your Free Quote Now

Fill out our simple form for a free, no-obligation quote tailored to your unique needs and secure your family's future now.

Preparing for the Future with Confidence and Care

Preparing for your future is important. Long-term care means getting help with health or personal needs as you reach old age. If you plan early, you can be sure you're in control of how you are taken care of later on.

What is Long-Term Care Insurance ?

Long-term care insurance is designed to cover the costs of personal and custodial care in a variety of settings such as your home, a community organization, or other facilities. This type of insurance is essential for anyone who might need prolonged care due to aging, chronic illness, disability, or other conditions. Long-term care insurance helps ensure you receive the care you need without the financial burden, preserving your savings and providing peace of mind for you and your loved ones.

Who Needs Long-Term Care Insurance?

Long-term care is a crucial consideration for various groups of people, primarily based on health status, age, and potential future medical needs. Key groups who might need long-term care include Older Adults, Individuals with Chronic Conditions, People with Disabilities or at Risk of Future Disabilities, Post-Surgery Patients, and Individuals with Cognitive Impairments.

Cost Considerations

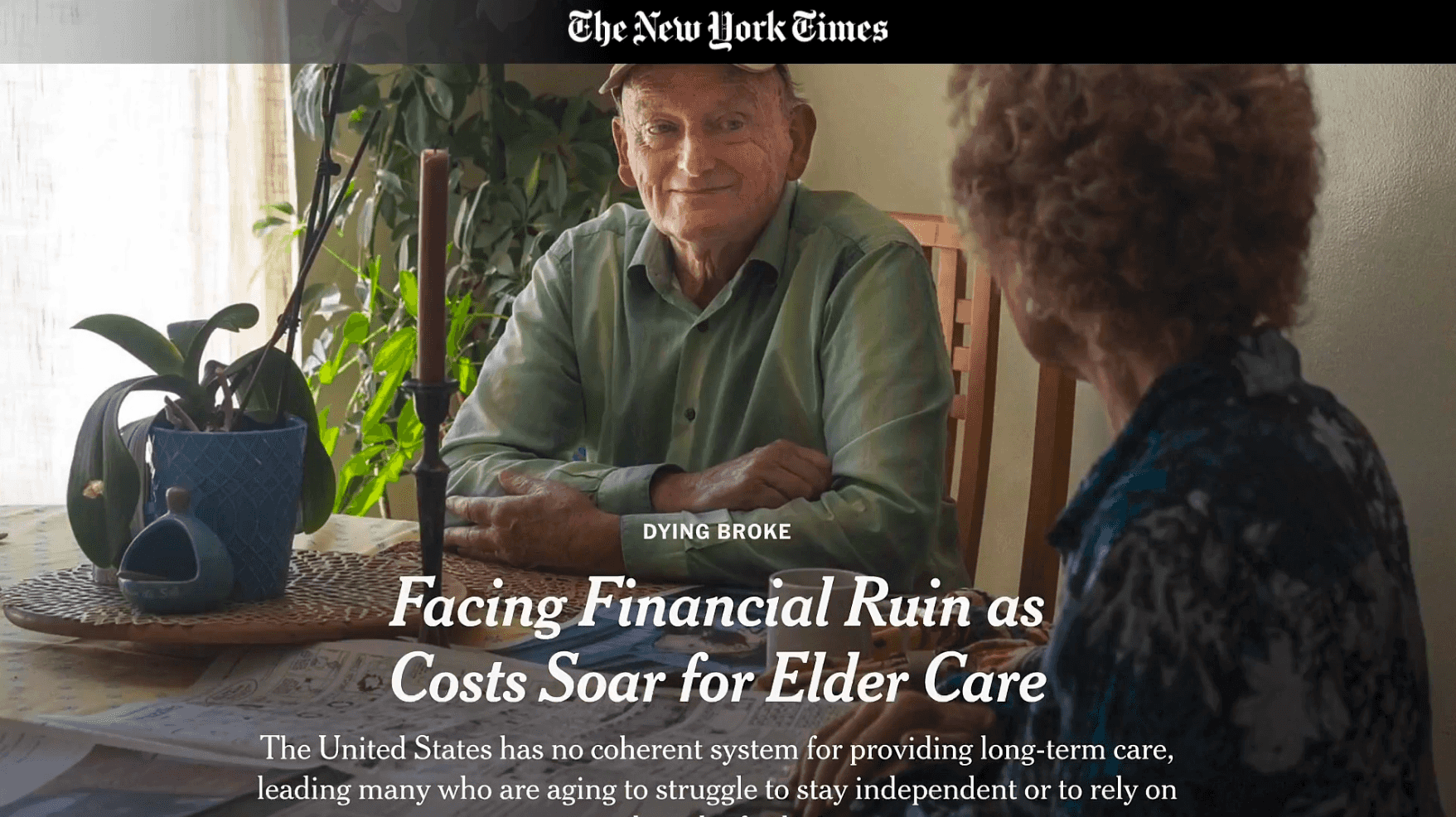

Understanding the cost considerations for long-term care is crucial for effective planning. Not planning represents the number one reason for bankruptcy in America. The expenses associated with long-term care—whether in-home care, assisted living, or skilled nursing facilities—can be substantial. Costs vary widely depending on geographical location, type of care, and the duration of care needed. Long-term care insurance can mitigate these expenses, preserving your savings and financial security.

Coverage Options

Long-term care insurance policies can be customized to cover a range of services including in-home care, assisted living, adult day care, and full-time nursing care. These policies help manage the substantial costs of long-term care, protecting your assets and ensuring you receive the necessary care without financial strain. It's important to consider factors such as the benefit period, daily benefit amount, and elimination period to tailor the coverage to your specific needs. Engaging with a knowledgeable insurance provider like Suriance early can help you navigate these options effectively, securing optimal coverage that aligns with your long-term health and financial planning goals.

Legislation around Long-Term Care is changing fast.

Could changes in your state impact your plans for the future?

- Legislation Passed

- Legislation Being Designed

- High Level Discussion Underway

- Considering Legislation

Cost of Care (USA - National)

| 2023 Costs | 2053 (Projected) | |

|---|---|---|

| Home Health Care | ||

| Homemaker Services | $5,720 | $13,884 |

| Homemaker Health Aide | $6,292 | $15,272 |

| Adult Day Health Care | ||

| Adult Day Health Care | $2,058 | $4,995 |

| Assisted Living Facility | ||

| Private, One Bedroom | $5,350 | $12,986 |

| Nursing Home Care | ||

| Semi-Private Room | $8,669 | $21,042 |

| Private Room | $9,733 | $23,625 |

Why Choose Suriance?

Experience the Suriance Difference: Unique Benefits Tailored to Your Needs

Nationwide Trusted Advocates at Your Service

Your Financial Future is Our Priority

Simplifying Complex Financial Solutions

Experience-Based Personalized Advice

Top-Tier Products Backed by Industry Leaders

Hassle-Free Online Application Process

No Medical Exams or Blood Tests Required

Get Covered the Same Day

Receive Quotes Within Minutes

Unmatched Customer Satisfaction Guaranteed

What our customers are saying:

Hayden

A trusted, stress-free source of life insurance for everyone.

Licensed Advocates

Our specialized licensed advocates are here to help you with all of your life insurance needs.

Same Day Coverage

Same day coverage with no medical exams or blood-work necessary.

Fast Quotes

Get your free quote now and compare the costs and benefits before you buy.